Infinix GT Book Review After Useses and Specifications

Infinix GT Book. The Infinix GT Book laptop has been introduced in the market in India as it features a Cyber Mecha design with LED […]

Infinix GT Book. The Infinix GT Book laptop has been introduced in the market in India as it features a Cyber Mecha design with LED […]

Railway Insurance: Does Railways provide insurance of Rs 10 lakh to passengers? Do you know? It would not be wrong to say that there is […]

Taxi Insurance: An insurance policy for commercial vehicles that protects taxis/cabs third party liabilities, accidents, natural calamities, fire, or theft. Every commercial vehicle must be […]

How to book hotel online from cleartrip If you plan to travel and need a hotel reservation, Cleartrip is easy and convenient. Here I have […]

Life Insurance – All You Need To Know This illustrates the fact that life insurance is essentially a contract through which the policy holder of […]

Best hotels with Taj view in Agra The crown jewel of Agra, the city of love, is the glorious Taj Mahal. Imagine waking up to […]

Highly Rated Hotels in Las Vegas The following is several Las Vegas luxury hotels. The Cromwell Las Vegas Hotel & Casino After years of being […]

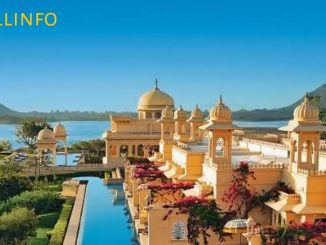

Most expensive hotels in India: know the list There are many luxury hotels in India where VIP treatment is given to people coming. These hotels […]

10 best hotels in Goa with amazing swimming pool Goa is the smallest city in India and is very famous for its beaches. If you […]

Top 10 hotels in Dubai The best hotel in Dubai is actually something of a disputed subject. Here is a rundown of some of the […]

Copyright © 2024 | WordPress Theme by MH Themes